You’ll likely be asked to complete a financial aptitude test if you are applying for a role in a bank or any other financial organization.

In order to successfully complete this aptitude test, you need to have a background in finance and excellent mathematical skills.

Many applicants get worried about the financial aptitude test. They don’t even know that with the right skills and adequate practice, they will pass the test and secure the job of their dreams.

The financial aptitude test evaluates the numerical and verbal reasoning skills of a candidate concerning finance.

You will be presented with a short passage of about 150 to 200 words and some related data shown in the form of a graph, chart, and table.

You will have to know the terminology, as well as how to analyze a text and pull out the relevant information.

You will have more time to complete each question as you are offered more text than the usual numerical reasoning tests.

The questions cover topics such as business statements, profit/loss margins, and balance sheets.

19 Important Facts about Financial Aptitude Test you need to Know

Here are important facts and tips about the financial aptitude test to help you succeed in it:

- What is a Financial Aptitude Test?

A financial aptitude test presents financial information to you through texts, tables, and graphs just the way that numerical reasoning tests do.

A lot of banks and other financial firms include the test in the early stages of their recruitment process.

In this case, the financial aptitude test must be completed before any formal interview can take place.

Because big organizations receive a huge number of applications, they use the financial aptitude test as a means to differentiate competent applicants from the incompetent ones.

Thus, hiring managers can quickly remove the candidates who are not a good fit for the role and rather spend more time on the applicants who have the chance to succeed.

2. What is the format of the Financial Aptitude Test?

In the financial aptitude test, you will be given a short description of a situation, including relevant numerical data.

Each question is likely to be accompanied by passages of 150 to 250 words, in which you will be asked to filter and extract the required information quickly and efficiently.

You will need to display knowledge of basic arithmetic like addition, subtraction, multiplication, and division, as well as percentages, rations, interests, and average.

You will be provided with a little longer time to complete the test if you are given more text than a standard numerical test.

The terminology used in the accompanying passages is what can make these tests complex.

You should get familiarized with phrases such as ‘market capitalization’ and ‘profit margin’ that are commonly used within the financial sector.

The financial aptitude test is also used to evaluate a candidate’s ability to complete more complex calculations.

These tests are scored differently and points could be deducted for providing wrong answers for you to be careful with the way you present your answers.

3. What does a Financial Aptitude Test assess?

The purpose of the financial aptitude test is to assess your mathematical skills as an applicant and understand large quantities of information.

In addition, your ability to work under pressure will also be assessed by the financial aptitude test.

The time limits of the test are usually very strong like the expected working style at several big financial organizations.

Your potential employer wants to examine your ability to work independently.

You are more likely to succeed in this industry if you can demonstrate strong independent working skills from the start.

4. What happens if I fail the Financial Aptitude Test?

It’s still possible to fail the financial aptitude test even with the most momentous amount of preparation.

Smaller organizations typically offer more flexibility in response to the test result you accomplish. Each application is likely to be viewed individually.

Your results will be weighed up with your supporting documents, and the hiring organization may be willing to advance to a formal interview if you have done very well in other areas.

This will give you the opportunity to prove yourself and display the competence you have for the role you are pursuing.

Bigger organizations typically receive thousands of applications and therefore use the financial aptitude test as a way to filter the candidates.

Those who fail the test will not likely proceed to the next round of interviews.

If you fail the financial aptitude test, your results will display the weaknesses in your understanding and provide you with a direct revision strategy to assist you to study before reapplying for other financial roles.

If you receive a rejection, know that the rejection may change to encouragement to keep on pursuing your selected career path.

5. What happens if I pass the Financial Aptitude Test?

Sometimes, you will know your results immediately after the test; sometimes your employer will receive the information first.

As soon as you have passed the financial aptitude test, you will likely be invited to a telephone interview and then a little more formal in-person interview.

You may also be required to conduct a presentation or pass other types of tests such as error checking tests during the interview process, but that depends on the role you are applying for.

Attending an interview will give you the opportunity to declare interest in the specific company you are applying to.

Make sure you carry out enough research and attend the interview prepared with actual reasons you desire to work for that company.

You should try to demonstrate competencies highly related to the finance industry if you are asked to attend a finance interview.

You will also be required to prepare for some more generic interview questions.

These are common questions you can find in most industries about why you want to leave your current job and your personal achievements.

6. What differentiates a Financial Aptitude Test from a Numerical Reasoning Test?

A financial aptitude test almost looks like the numerical reasoning test except that the financial aptitude test is more text-based.

A few of the financial institutions that are recognized for using the financial aptitude test as part of their assessment include Barclays, HM Revenue and Customs, Deutsche Bank, Ernst and Young, Financial Services Authority, Royal Bank of Scotland, HSBC Bank, Citigroup, KPMG, PWC, and BDO.

Numerical aptitude tests are purely based on numbers and generally contain a series of mathematical equations for the candidate.

Employers are eager to assess your comprehension skills to be confident that candidates can comprehend text and get rid of irrelevant information.

Your ability to understand texts with solving mathematical problems will also be evaluated. The calculations are usually more complex and in-depth on financial aptitude tests.

7. Which employers use the Financial Aptitude Test?

Employers in the finance sector such as banks, insurance companies, and investment firms use the financial aptitude test during their hiring process.

It’s not only financial firms that make use of the financial aptitude test; any company that requires a strong understanding of mathematics may decide to take up this test as part of their application process.

8. How is the Financial Aptitude Test scored?

Scoring of the financial aptitude test depends on which supplier is used. You may be informed of the test provider by the employer in advance.

This information will help you, particularly in the preparation stages. You need to confirm with the test provider in advance if the test you are taking is marked negatively.

Most tests will be multiple-choice, with one correct answer. However, there may be occasions where a second answer is worth half of the marks.

The average score for the financial aptitude test is 80%. Sometimes, this may exceed this figure when there are an extraordinarily high number of candidates.

9. What do I expect from a Financial Aptitude Test?

Every organization uses a financial aptitude test specific to the demands of the business. However, the general format is typically the same.

Some of the questions you will likely come across during the financial aptitude test usually involve tables and graphs of data.

You will be required to complete a calculation with the information you get from the charts. Your knowledge of financial terminology will be assessed by other questions.

10. Tips on how to answer Financial Aptitude Test questions

These tips will help you to learn how you can answer the questions you will meet on the financial aptitude test:

- Recognize the essential information

Understanding the information presented is the first step toward answering the questions. A passage will contain the details of the scenario, and you will then be required to find certain information.

You can’t even start the calculations unless you first identify the relevant pieces of information by carefully reading through the text and taking out the related figures.

You will have to work through a lot of data because many of the questions involve tables and graphs. But don’t get overwhelmed by the information as you will need only a few figures for any given equation.

- Discover what these questions actually want from you

It can be easy to lose track of the actual question with lots of written financial aptitude test questions.

You might be tempted to jump start right away if you have worked on this type of material before in graduate school or college.

Check your work very well to see if you are answering according to the questions asked and that your answers conform to the pattern expected.

- Be fearless

The majority of the equations are fairer than you think. Just make sure you separate the correct pieces of information.

The two challenges you will face are the complexity of the questions and the pressure of the time limit.

As you are trying to understand the question, get comfortable working with numbers and you will see you don’t have to panic over difficulties with the math section.

11. How to prepare for the Financial Aptitude Test?

You will need to prepare with finance-related questions if you have a financial aptitude test for a job interview.

Most of the questions on this test are word-related problems and will require you to analyze financial data.

The financial aptitude test is actually designed to assess your ability to apply numerical reasoning to the world of finance, although you will need to calculate percentages and estimate probability.

Here are a few things you should do if you desire to prepare for the financial aptitude test:

- Inquire to know the test publisher

Most employers will be willing to reveal the publisher of their financial aptitude tests. By knowing the name of the company that provides the test that you are taking, you’ll be able to find sample questions online to practice with..

This highlights your engagement and passion for your potential new employers, and will also help ease any nerves before the test. With these traits, you can be set apart from your competition.

- Practice under time limits

Practicing under time limits is the best way to prepare for a financial aptitude test. The pressure this has mounted should urge you to prepare.

There are many practice tests available online that usually come with time restraints that can be utilized for your revision.

- Revise financial terminology

All through the financial aptitude test, your understanding of financial terminology will be assessed. You need to spend time revising, researching, and practicing your mathematics.

Common terms such as equity and bond should be revisited, as well as company-specific terminology.

12. What are the three key skills required for the Financial Aptitude Test?

Here are the three key skills employers are looking for that you need to possess for your financial aptitude test. These include:

- Analytical financial skills

- Long-term financial modeling

- Knowledge of financial statements and analytical techniques.

13. What types of questions will appear during the Financial Aptitude Test?

The financial aptitude test consists of the following:

- True or False Questions

- Multiple Choice Questions (MCQ’s)

- Multiple Answer Questions (MAQ’s)

- Fill in the Blanks

- Job-based Simulations

- LogicBox (AI-based evaluation)

- Whiteboard Questions

- Audio/Video Questions

- Descriptive.

14. What is the job role for which the Financial Aptitude Test is used for hiring?

The financial aptitude test is designed with EEOC guidelines in mind. The test helps employers to assess and hire different talents without any prejudice.

The finance-based assessment can be used to hire financial analysts who are responsible for financial planning, analysis, and projection for companies and make decisions on capital budgeting for projects. The financial aptitude test is also used to hire finance managers.

15. Employ the best financial professionals using the Financial Aptitude Test

Financial analysis is seen as one of the most valuable careers in the financial services industry.

Those employed to work in this industry are responsible for internal and external clients, as well as analyzing data to explore opportunities or evaluating business decisions or investment proportion results.

The role of a financial analyst employed to work in either junior or senior capabilities with an organization may be titled analyst, investment analyst, securities analyst, equity analyst, or rating analyst.

Analysts use their general accounting and compliance experience to study accumulated financial data, predict outcomes, drive processes, and make policy improvements.

Most tasks that financial analysts perform are crucial, including rectifying financial and operational issues, reviewing substantial investment proposals, and getting acquainted with industry conditions and competitor initiatives.

16. What are the key accountabilities for Financial Analysts?

The key accountabilities for financial analysts include the following:

- Analyzing financial and operational results and suggesting possible improvements

- Analyzing and suggesting multiple types of investments based on a risk-return analysis

- Evaluating capital budgeting proposals and making approval recommendations to management

- Staying informed of the latest industrial developments

- Performing cost-benefit analyses

- Predicting future business conditions using different scenarios

- Performing competition analysis

- Preparing financial models

- Preparing spreadsheets and presentations, compiling the findings of the analyses and sharing the outcomes with the senior management

- Staying up to date with developments in those industries in which the company operates

- Reviewing and preparing reports based on previous and current financial data

- Creating projections and reports based on financial analyses

- Assessing capital expenditures and depreciation

- Exploring multiple investment opportunities

- Creating and evaluating profit plans.

17. What are the essential skills that employers are looking for in a Financial Analyst?

There are important skills that employers expect to see in a financial analyst. These include:

- Strong understanding of financial statements and analytical methods: This includes financial analysis, financial management, and basics of accounting and management accounting.

- Knowledge of analytical and financial modeling: This involves excel modeling and probability, as well as statistics.

18. What types of financial analyst interview questions will you see?

You need to know the common questions that are asked in a financial analyst interview. Some of these questions include:

- Why have you chosen a particular organization?

- Why do you want to build your career in financial analysis?

- What would your action be if you find out errors in the details of a cash flow statement

- What programs would you use to make reports with graphs, charts, and spreadsheets?

- What does EBITDA mean and what is the calculation all about?

- How would you manage sad internal customers during business meetings?

- Where do you foresee yourself to be in the next five years?

- How would you propose an investment recommendation for top management?

- Describe when you have to deal with tight deadlines

- Portray a time when you had a disagreement with your team.

19. What are the nine Financial Aptitude Test tips you should know?

Here are nine major financial aptitude test tips you need to know:

- Get your toolkit ready

- Be mindful of timing

- Practice in an exam condition

- Understand the thought process of each question

- Discover your weak points and work on them for improvement

- Get yourself a pen and enough rough paper for workings

- Stay calm and focused

- Ask your employer what kind of psychometric test are you going to take

- Learn to be regular with your practice.

Financial Aptitude Test Practice Questions and Answers

You can’t mention preparation for the financial aptitude test without practicing with sample questions. The examples here are designed to help you know how the test will be.

Question 1

What is the enterprise value of a company?

- The whole value of the business

- The whole value of the business considering its capital structure

- The business equity market value

- The business equity book value

The correct answer is: B

Notice the very insignificant difference between answers A and B.

The first answer is not completely wrong, while the second answer shows the full response for the question asked.

Question 2

Find the next number in this sequence:

1, 5, 4, 16, 14, 42, and what is next?

- 41

- 5

- 62

- 39

The correct answer is: D. 39

You will not be asked to prove your work during the financial aptitude test. Yet, it is clear that you understand the underlying algorithm while choosing the correct answer.

A collection of practice questions should be completed while preparing for the test. During the revision process, it’s always best to keep your focus on the weaker areas.

Question 3

You need to purchase an industrial printer to use for a printing job that requires you to print five hundred thousand units. You have narrowed your choices down to 3 models, all of which can be installed with adequate ink so as to print X number of units. The purpose is to purchase a printer whilst keeping company spending to a minimum, which model should you purchase?

Answer: C

Explanation:

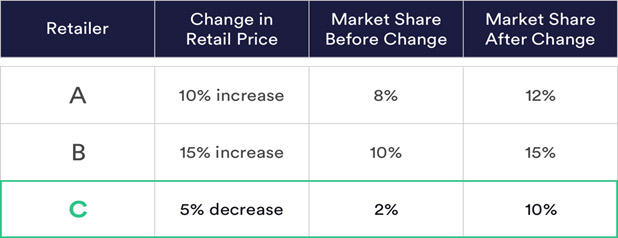

We have to use an example figure that we create as we are not given a retail price before the change.

Take $1 as the starting price for the product:

You are to calculate new retail price for every retailer:

$1 x 1.1 = $1.1,

$1 x 1.15 = $1.15,

$1 x 0.95 = $0.95.

What is the market share value before change, assuming total market share is 100:

$8, $10, $2.

Calculate the market share value after change, assuming total market share is 100:

$1.1 x 12 = $13.2,

$1.15 x 15 = $17.25,

$0.95 x 10 = $9.5

What is the difference in market share value before and after change:

$13.2 – $8 = $5.2,

$17.25 – $10 = $7.25,

$9.5 – 2 = $7.5

The largest increase is $7.5 meaning retailer C saw the highest increase in revenue.

It’s been an invaluable resource as I could prepare for specific companies and industries.

Conclusion

The financial aptitude test is generally used by employers in banks and finance offices and other sectors where analytical ability is required.

This test is used to challenge diverse skills, including mathematical ability and time management, and the ability to work under pressure.

The financial aptitude test involves questions on a variety of large quantities of text, graphs, and charts.

There are many practice tests you can find online and make use of them before you take the real test.

It’s very necessary that you pass these tests as a job applicant in order to move to the next stage in the interview process and finally get the job.

>> Learn how to make a great score in Aptitude Tests, including IBEW/NJATC electrical aptitude test, situational judgement test, Kenexa, trade apprenticeship, Exxonmobil, civil service, firefighter exam, FBI test, etc. ; prepare for the test with free but effective practice tests.